Action on Private Bank: Why did the Mohan Sarkar stop transactions with three banks?

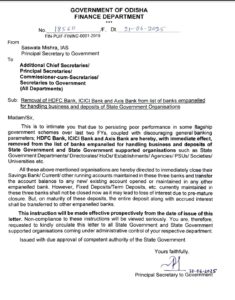

Odisha Govt Bans Business With HDFC, Axis, And ICICI Banks: Odisha Government Bans Business With HDFC, Axis, And ICICI Banks: Mohan government stopped government financial transactions with HDFC, ICICI, and AXIS Bank. All departments have been instructed to close accounts in these banks. The Finance Department has taken such a tough decision as the Lokabhimukhi scheme has failed to be implemented. This is the right step of the government in the interest of the state, while economic experts have said that the money of the common man is completely safe in these banks. On the other hand, the bankers have expressed their concern that this decision will affect the business of these banks in the state.

The Mohan government’s tough message to banks. If you want to do business with the state government, give importance to the implementation of the Lokabhimukhi scheme. Maintain normal banking standards. The Finance Department has given such a tough message by excluding three large private banks like HDFC, ICICI, and AXIS Bank from the list of banks listed for conducting business with the state government and various government institutions like directorates, corporations, public enterprises, and universities.

Yesterday, the Finance Secretary wrote a letter to all the departments and directed them to immediately close all the savings, deposit, current and other accounts of various departments, directorates, departmental headquarters, institutes, corporations, public sector enterprises, etc. in these three banks. Similarly, the deposits in these banks have been asked to be transferred to other empanelled banks. However, since fixed deposits and other term deposits of government institutions were kept in these three banks, due to loss of interest due to early withdrawal, this amount has been directed to be transferred to other empanelled bank accounts after maturity.

According to economic experts, this is a wise step in the interest of the state. However, the deposits of the common people in these banks are completely safe. Banking experts say that since these large private banks account for about 30-40 per cent of the government’s banking transactions, their business in the state will be affected.

What does the government empanel banks? Which government funds are deposited in these banks?

The former special finance secretary said, banks are empanelled on the basis of implementing government schemes and some other criteria. Similarly, to keep the funds of various departments, public sector enterprises, corporations and other government institutions, their funds are kept in empanelled banks that pay high interest through tenders based on specific criteria. Various state schemes and central scheme funds are also kept in these banks.

ALSO READ: What Is The Indian Army Salary